I am looking for a legal expert in

in

Leader in the Smart Home market, Delta Dore brings in three new private equity funds: Arkea Capital, Unexo and BNP Paribas Développement

Following the decision by Schneider Electric, a European player in electrical distribution and automation, to sell its 20% minority stake, the Renault family, Delta Dore’s majority shareholder, has decided to favour investment funds as its new partners. This decision will enable the company to provide long-term support for its “Smart Ignition” strategic plan through to 2030. The three bank funds involved are Arkea Capital (Crédit Mutuel Arkea group), Unexo (Crédit Agricole group) and BNP Paribas Développement.

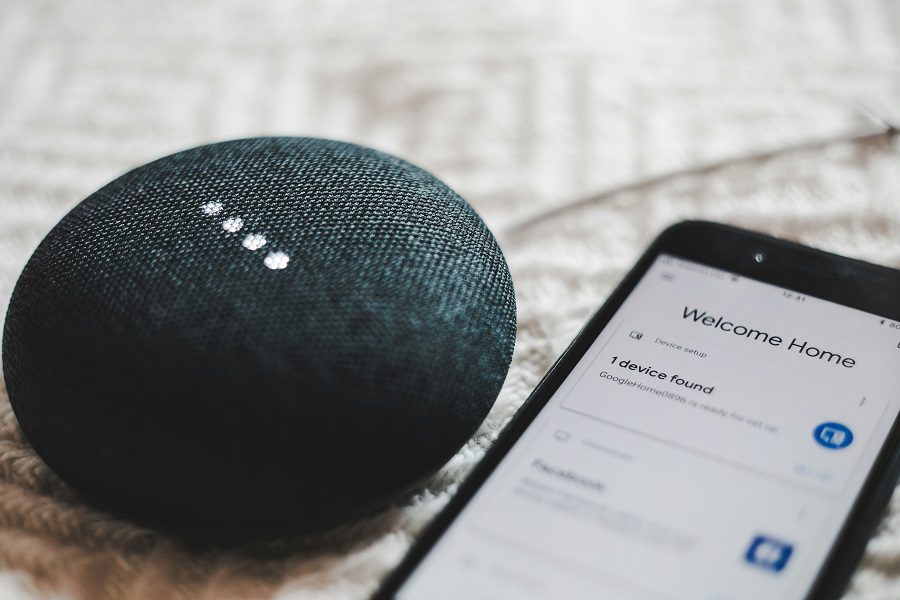

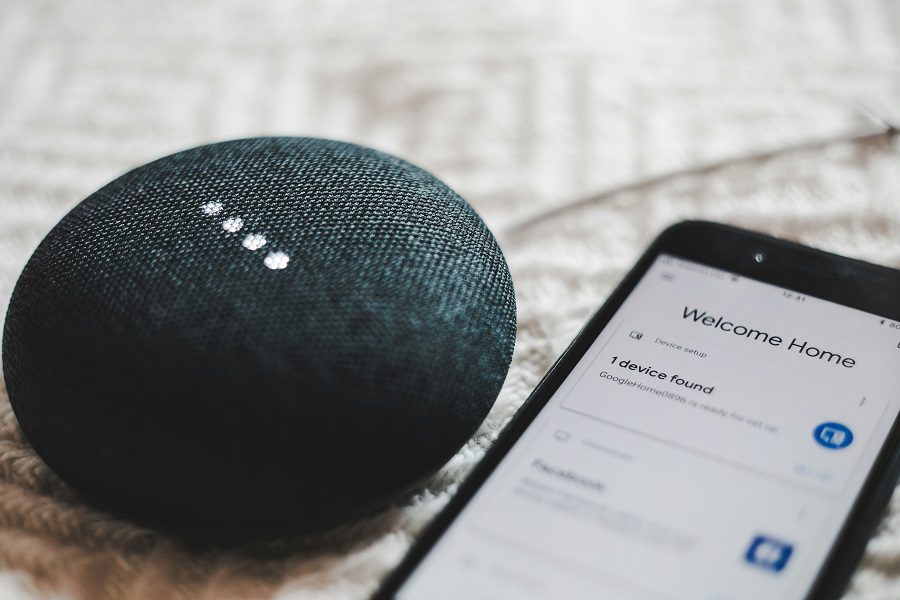

Delta Dore was founded in 1970 and specialises in connected objects for the home. It currently employs 820 people. The company now has 6 subsidiaries (France, Germany, Spain, Italy, Poland and the UK), and every year it manufactures 4.5 million products in France and 0.5 million in Germany.

After reorienting its activities towards the connected home market in 2021, Delta Dore has taken a new step by openly targeting the general public since last year.

This transition, while not having a major impact on the company’s governance or operations, represents a significant strategic move for Delta Dore. It comes at a time when energy management is responding to increasingly pressing challenges, particularly in terms of reducing the carbon footprint of homes and saving energy for households.

Stakeholders :

Purchasers :

– Arkéa Capital: Eric Besson-Damegon, Kévin Chaigneau, Alban Germain

– Unexo: Antony Lemarchand, Antoine Martiarena, Pierre-Emmanuel Lemarchand

– BNP Paribas Développement: Yannick Carré, Thomas Holin, Fanny Paganelli

Advisors :

Avocats Conseils Investisseurs : CVS Avocats (Matthieu Guignard), Fidal (Jacques Darbois)

Family and management consultants: EY Avocats (Bernard Martinier), Claris Avocats (Jean-Pascal Amoros)

Financial sales advisors : Messier & Associés (Hubert Preschez)

Legal sales advisors: Bredin Prat (Clémence Fallet) ;

Financial SDV: EY (Gratien de Pontville)

Strategic due diligence: Roland Berger (Gregory Jarry)

Financial due diligence: Oderis (Maxime Girard)

Legal, tax and employment due diligence: KPMG Avocats (Olivier Robin)

Strategic due diligence: Kairn Strategy (Olivier Burban)